Digital technologies such as Blockchain are flagbearers of a new era of productivity in banking and financial institutions. Besides this, an increasing number of industries, such as consumer goods, aerospace and defense, and healthcare are adopting Blockchain to push their boundaries of novelty. Even at a nascent stage, the technology has caused disruption across diverse sectors. Its features such as transparency, decentralization, and immutability are deemed highly lucrative by a multitude of businesses.

Table of Contents

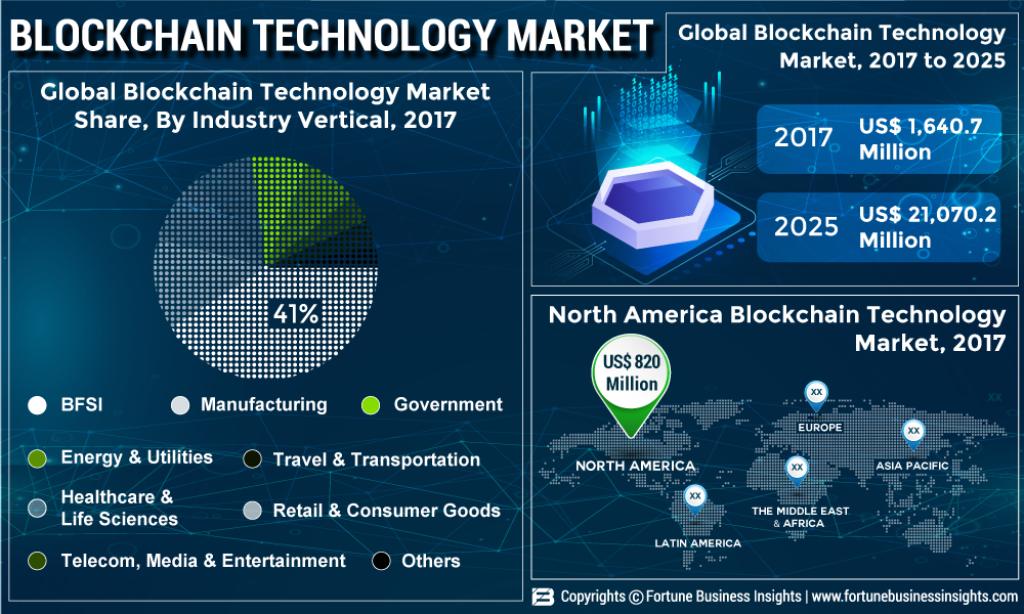

Early Adoption in North America Proves Chief Growth Booster for Blockchain Technology

Blockchain technology is riding high on popularity, with a considerably large section of financial executives showcasing their familiarity with the technology. North America boasts a considerably larger percentage of familiarity of the technology. Some of the leading names in the market are domiciled in the U.S., which is a prime factor boosting the Blockchain technology market in North America. Besides this, the dominance of manufacturing industries will give tailwinds to the growth of market in Europe. In Asia Pacific, the technology is likely to discover lucrative markets in China, Japan, and Korea.

IBM’s Diversification Strategy Catapults it to Market’s Forefront

Start-ups and smaller companies are mostly adopting organic strategies to strengthen their foothold. For instance, partnerships and strategic collaborations are extremely popular among start-ups looking to consolidate market share. For instance, R3 teamed up with HSBlox in 2018 to develop novel Blockchain initiatives and offer Blockchain solutions to the Corda Healthcare Community-based healthcare industry. Meanwhile, their multinational counterparts seldom leave any stone unturned to gain competitive edge. However, experts often tout growth strategies by leading players as non-organic. For instance, IBM announced a joint venture with Maersk Group to implement Blockchain technology to the benefit of global trade. They also aimed at digitizing supply chain.

Besides collaborations, biggies like IBM Cooperation are focusing product diversification to stay competitive. They are also taking keen interest on making their frontline Blockchain products easily accessible. The company’s effort is evidently directed towards strengthening their distribution network, subsequently penetrating deeper into untapped markets. Moreover, IBM’s has over 8 ongoing projects with over 130 associates across 25 countries, working in harmony to develop Hyper Ledger Fabric Project. Reiterating IBM’s stronghold, Fortune Business Insights has touted IBM as the leading market player in 2017.

Blockchain Technology is Becoming Increasingly Attractive for Global Financial Institutions

Back in the days, Blockchain technology was treated with cynicism in bank and financial institutions. However, success registered across diverse sectors has impelled the banking sector to actively seek novel applications of the Blockchain technology. With companies such as JP Morgan Chase placing their faith in the technology, experts foresee promising growth on cards for the overall market. JP Morgan Chase has recently started a facility called the Quorum division, dedicated to conduct researches on and implement the Blockchain technology. In addition to this, Goldman Sachs is actively engaged in the research and development of distributed registry technology. The company has already invested in Circle – a cryptocurrency project. Circle is touted as one of the most well-funded projects in the Blockchain space.

Blockchain technology offers security of transaction, while eliminating the involvement of any third party trustee. This one characteristic greatly helps in curbing cost incurred on financial transactions. Apart from this, the technology is beyond bitcoins and can be implemented across a plethora of operations, such as document verification or sending encrypted messages securely. Furthermore, it allows integration of smart processes such as “smart contracts,” which potentially automates manual processes. These are indicative of secure transaction offered, which is fueling the demand for Blockchain technology worldwide.

Blockchain Technology offers a host of advantages to the banking and financial institution. Some of them are discussed below:

- One of the most interesting aspects of Blockchain technology is that it combines cryptography and databases, while allowing simultaneous access to multiple parties from across the globed regularly update digital ledger.

- Implementing the technology will empower banks and financial institutions to tackle with frauds.

- A considerably large section of financial intermediaries is vulnerable to cyberattack. Implementing Blockchain technology can shield a company against a number of potential online threats.

- Blockchain disruption is slated to transform payment processes, ascertaining greater security to banks.

- It also significantly reduces the cost incurred on processing payments.

The Blockchain technology is yet to be capitalized on to its full capacity and it is already leveraged across multiple industries. As more companies realize the benefits of implementing the technology and agree on common solutions, the impact could be ground-breaking. With leading financial institutions experimenting with the technology across fields as diverse as anti-money laundering, syndicated loans, CRM, and payments, the future could be nearer than expected.

Author Bio:

Panchali Mallik Tripathi is currently heading the content writing/ editing team at Fortune Business Insights. Panchali’s extensive experience as a content expert in the IT industry has stirred her inquisitiveness to research on the historical, contemporary, and unexplored nuances of the novel technologies and scientific developments. Other than this, she also enjoys investigating the latest advances in the digital world and how the same is likely to impact economies worldwide.